- 16,387

- 20,290

- Joined

- Aug 5, 2007

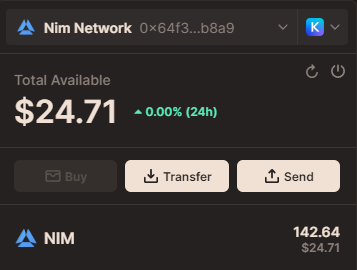

ikr! the apy in the farm is still great, especially if you're bullish on fira cause that 12 month unseal is a great idea for game longevity but bad for liquidity. looks like some heros will unseal fira quicker and that's pretty cool too. is that how dfk works? kinda want to deploy more into the pool but that fira price has been on fire.But whatever I sell, going right into Defira so I can try to catch up to @fapmasterjr's farming numbers

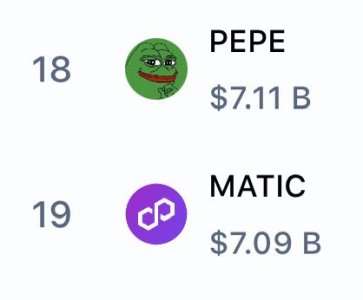

and now it’s a solid #2 in my portfolio and creeping up on #1.

and now it’s a solid #2 in my portfolio and creeping up on #1.