- 5,038

- 6,175

- Joined

- Jun 22, 2018

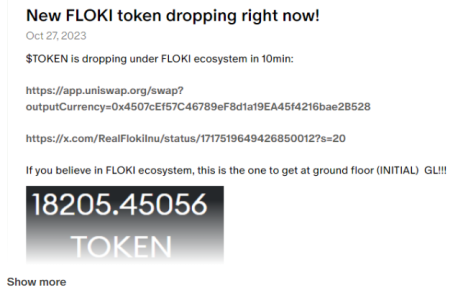

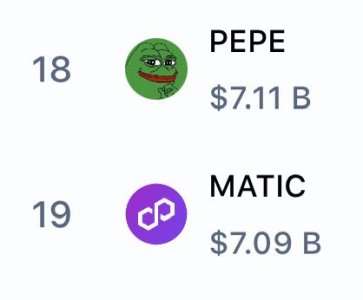

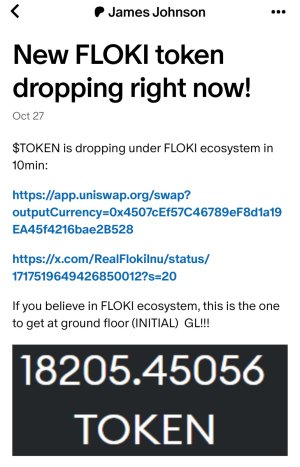

Had a convo with a friend last weekend regarding regulation and adoption of crypto. I disagree with most of his crypto musings but agree it won't be adopted unless it's regulated. Why? People are people and are unable to self 'police' themselves in anything. I told him I want the same chance to get over in people that the watchers have. In crypto now anybody can engage in the ponzinomics