- 3,171

- 7,605

- Joined

- Nov 18, 2016

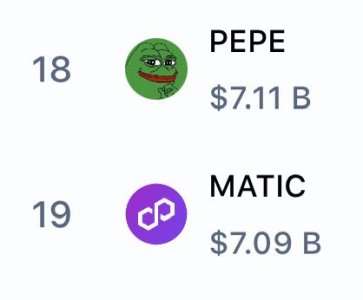

great dialogue u guys are having. can we agree that cryptocurrency is having an effect on traditional banking? sure its a small .001 %, but 600billion isn't something that can be disregarded:

sports.yahoo.com

sports.yahoo.com

Am I saying that cryptocurrency will take over modern day banks/fiat.....maybe not in our lifetime. How has it been the past 10+yrs since 2009....have we changed the narrative at all? I think being digital and not carrying "paper" is a start....excited to see what happens the next 5yrs. Remember tech moves fast vs traditional.

JPMorgan Discusses $600B in Potential New Bitcoin Demand

MassMutual’s $100M BTC investment has the potential to open a massive new investment category, according to analysts.

Am I saying that cryptocurrency will take over modern day banks/fiat.....maybe not in our lifetime. How has it been the past 10+yrs since 2009....have we changed the narrative at all? I think being digital and not carrying "paper" is a start....excited to see what happens the next 5yrs. Remember tech moves fast vs traditional.

what’s the context behind the chad term?

what’s the context behind the chad term?