- 3,995

- 4,930

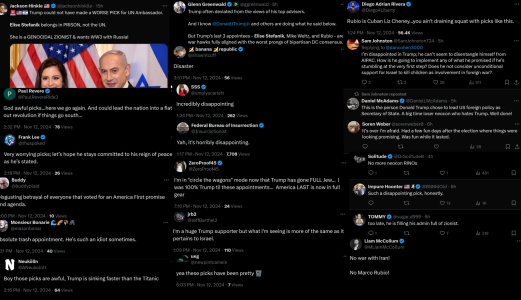

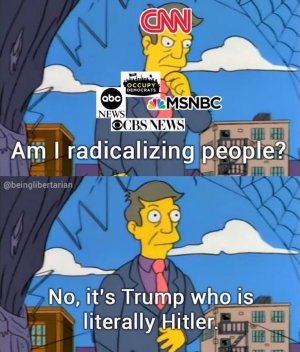

you can tell who really reads into the actual issues....

insults like "those liberals... lefties.. etc" show how brainwashed blc02 and that other guy are...

the republican party is dead... true conservatives need to form a new party and drop the dead ideologies that were built in their name.

insults like "those liberals... lefties.. etc" show how brainwashed blc02 and that other guy are...

the republican party is dead... true conservatives need to form a new party and drop the dead ideologies that were built in their name.

Last edited: