- 146,318

- 177,796

No huge disagreements but just he's a bit too Keynesian oriented for my likingFamb you usually don't agree with Krugman?

Dude is probably one of the best left wing economic minds out there.

I do like a lot of his work regarding inequality though as well as his approaches to supply side and deficits.

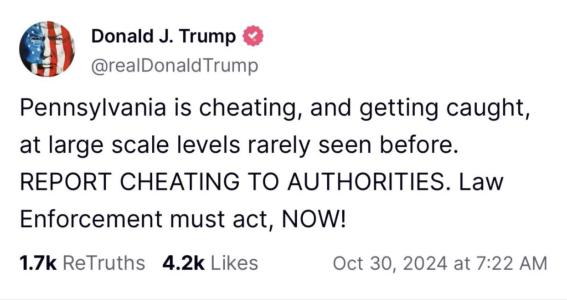

He's been really on point in his critiques of the current admin,hasn't minced words about taking a hammer to all the nonsensical proposals coming out of the orange house

Last edited: