Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

OFFICIAL STOCK MARKET AND ECONOMY THREAD VOL. A NEW CHAPTER

- Thread in 'General' Thread starter Started by johnnyredstorm,

- Start date

- Sep 28, 2004

- 13,924

- 5,900

401k down 18% YTD. Stocks thst I’ve been in 5 plus years are barely hanging in there now. So I guess I’m doing alright. The dca has had its benefits.wallyhopp thank you for the follow-up, my friend

Had I bought Any hype pandemic stocks and held, I’d be down 85-90%, so I feel lucky.

How you been doing.

- Jul 13, 2005

- 35,417

- 27,031

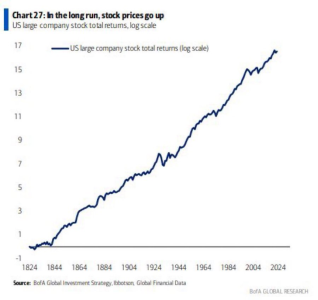

2008 drop was 50%? So this really ain’t nothing.

- Sep 28, 2004

- 13,924

- 5,900

I’ve shared random bits. But even the 2018 drop had a decade worth of growth wiped away almost instantly. I was down 15-25% overall. And then late 2020 to 2021 saw 50-60% growth once again. I’m still up 33% from 2 years back, and now down 7% one year out.2008 drop was 50%? So this really ain’t nothing.

It’s truly all ups and downs and rebalancing it all.

My 401k is rather new as I’m not too old. But overall, it’s at a positive 18%, not including any 10% tax breaks. So there is still value in this dinosaur.

- Nov 10, 2007

- 9,134

- 1,012

RH seems alright, don't do all my trades through there though

If worst comes to worst, another exchange would probably just buy RH and it's users

Not expecting a Coinbase situation...

If worst comes to worst, another exchange would probably just buy RH and it's users

Not expecting a Coinbase situation...

- Mar 22, 2003

- 29,002

- 17,669

RH seems alright, don't do all my trades through there though

If worst comes to worst, another exchange would probably just buy RH and it's users

Not expecting a Coinbase situation...

Nah - user base overlaps with what the main brokerages already have + they sell their data to Schwab, etc

Beruseruku Desu

Supporter

- Oct 10, 2018

- 12,682

- 26,685

- Dec 23, 2009

- 30,363

- 21,941

Well boys, we did it. Bear market canceled

- Apr 16, 2014

- 24,063

- 48,678

Well boys, we did it. Bear market canceled

YOLO into OTM NVDA calls then?

Instructions not clear.

- Oct 10, 2005

- 21,580

- 12,427

- Dec 23, 2009

- 30,363

- 21,941

Sell unsecured puts on PTON.YOLO into OTM NVDA calls then?

Instructions not clear.

- Mar 22, 2003

- 29,002

- 17,669

YOLO into OTM NVDA calls then?

Instructions not clear.

Heard of Robinhood?

- Jul 13, 2005

- 35,417

- 27,031

Completely forgot AMZN split is official in a couple of weeks.

- Jan 12, 2017

- 1,097

- 729

Stock picking is a tough game. If you're like me, Q1 and Q2 of 2022 have made me question my ability as a stock picker

Many of my investments were driven by speculation, rather than prudent investment. ***** has felt brutal, but it's a marathon, not a sprint

Many of my investments were driven by speculation, rather than prudent investment. ***** has felt brutal, but it's a marathon, not a sprint

- Dec 23, 2009

- 30,363

- 21,941

You'll learn. You got time and this environment is a good learning experience. Some of us graduated high school/were in college during the Great recession and went through a similar learning experience. One thing you learn is that good companies can become **** companies overnight, so don't marry anything. Except AAPL.Stock picking is a tough game. If you're like me, Q1 and Q2 of 2022 have made me question my ability as a stock picker

Many of my investments were driven by speculation, rather than prudent investment. ***** has felt brutal, but it's a marathon, not a sprint

- Oct 10, 2005

- 21,580

- 12,427

You'll learn. You got time and this environment is a good learning experience. Some of us graduated high school/were in college during the Great recession and went through a similar learning experience. One thing you learn is that good companies can become **** companies overnight, so don't marry anything. Except AAPL.

And NVDA

.

.- Dec 3, 2007

- 8,180

- 5,405

Attachments

- Aug 19, 2015

- 8,320

- 7,174

She must not have been working in Denver 2 weekends ago

- Aug 9, 2014

- 12,849

- 28,002

Well Snap died

- Dec 3, 2007

- 8,180

- 5,405

Question for the more experienced traders:

Snap's admission last night that they would not meet the street's expectations basically tanked companies that rely on ad revenue. The news came after hours, so if you wanted to take advantage, you'd have to wait for market opening today (if you're the average investor), which by some measure was a littke late to play the news. All that said, was Snap's announcement an example of "buy the rumor sell the news"? If yes, how exactly do you take advantage of the rumor when it happens after the market closes?

...

Snap's admission last night that they would not meet the street's expectations basically tanked companies that rely on ad revenue. The news came after hours, so if you wanted to take advantage, you'd have to wait for market opening today (if you're the average investor), which by some measure was a littke late to play the news. All that said, was Snap's announcement an example of "buy the rumor sell the news"? If yes, how exactly do you take advantage of the rumor when it happens after the market closes?

...

- Aug 9, 2014

- 12,849

- 28,002

Slapping puts would’ve worked, even off open. Obviously opening the position yesterday would’ve banked harder but still worked todayQuestion for the more experienced traders:

Snap's admission last night that they would not meet the street's expectations basically tanked companies that rely on ad revenue. The news came after hours, so if you wanted to take advantage, you'd have to wait for market opening today (if you're the average investor), which by some measure was a littke late to play the news. All that said, was Snap's announcement an example of "buy the rumor sell the news"? If yes, how exactly do you take advantage of the rumor when it happens after the market closes?

...

- Dec 23, 2009

- 30,363

- 21,941

LikeQuestion for the more experienced traders:

Snap's admission last night that they would not meet the street's expectations basically tanked companies that rely on ad revenue. The news came after hours, so if you wanted to take advantage, you'd have to wait for market opening today (if you're the average investor), which by some measure was a littke late to play the news. All that said, was Snap's announcement an example of "buy the rumor sell the news"? If yes, how exactly do you take advantage of the rumor when it happens after the market closes?

...

Still not a good time buy long term holding positions.

- Aug 9, 2014

- 12,849

- 28,002

You sure about that? LolLike206to813 said, early day play was puts on opening but closing quickly for a quick scalp. The play now is short term calls. We still close red but not as bad.

Still not a good time buy long term holding positions.

- Aug 9, 2014

- 12,849

- 28,002

Nvda earnings tomorrow

Similar threads

- Replies

- 111

- Views

- 17K

- Replies

- 22

- Views

- 2K

- Replies

- 38

- Views

- 4K