Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

OFFICIAL STOCK MARKET AND ECONOMY THREAD VOL. A NEW CHAPTER

- Thread in 'General' Thread starter Started by johnnyredstorm,

- Start date

- Jul 27, 2013

- 12,095

- 14,916

We moved on to APDN (posted this am in Covid thrd)So have I missed the SIGA train? I'm seeing they have earnings this week (the 4th?), think they could provide a catalyst for another/continuing run?

Last edited:

- Dec 23, 2009

- 30,363

- 21,941

It looks like I'm late to that tooWe moved on to APDN (posted this am in Covid thrd)

But good **** if you got in before today!

But good **** if you got in before today!

- Dec 23, 2009

- 30,363

- 21,941

MTCH yikes yikes yikes. Guess $BECKY ain't out there ****in this year.

- Jul 27, 2013

- 12,095

- 14,916

Ecuarenta Legendsofthebay GIF - Ecuarenta Legendsofthebay Coyotemedia - Discover & Share GIFs

Click to view the GIF

Last edited:

- Oct 16, 2010

- 2,330

- 2,088

Where is the guy with the dollar bill pyramid avatar. Dude was the ultimate bear, made money off them shorts. A couple years ahead of all of us.

Retired + traveling the world.

Pretty much nailed the crypto top almost to the day (short BTC at 66k while all influencers were screaming 100k) and been chilling since.

Still keep up with the markets, still trade for fun, glad to see

)

)- Mar 22, 2003

- 28,995

- 17,663

Retired + traveling the world.

Pretty much nailed the crypto top almost to the day (short BTC at 66k while all influencers were screaming 100k) and been chilling since.

Still keep up with the markets, still trade for fun, glad to seeshibadekobe back , already know he's having just as much fun as me in these market conditions too ($HKD ?

)

Welcome to retirement my dude

- Jul 27, 2013

- 12,095

- 14,916

Congrats! Glad to hear you're doing well.Retired + traveling the world.

Pretty much nailed the crypto top almost to the day (short BTC at 66k while all influencers were screaming 100k) and been chilling since.

Still keep up with the markets, still trade for fun, glad to seeshibadekobe back , already know he's having just as much fun as me in these market conditions too ($HKD ?

)

Saw HKD vol go nuts @ $700..avoided and hit up APDN instead.

- Sep 27, 2003

- 6,817

- 4,744

Love to hear it. Never too big for NT and come back and visit soon.Retired + traveling the world.

Pretty much nailed the crypto top almost to the day (short BTC at 66k while all influencers were screaming 100k) and been chilling since.

Still keep up with the markets, still trade for fun, glad to seeshibadekobe back , already know he's having just as much fun as me in these market conditions too ($HKD ?

)

Enjoy NT fam!

- Mar 22, 2003

- 28,995

- 17,663

Industry is back on HBO for season 2

- Aug 22, 2007

- 5,494

- 2,469

Industry is back on HBO for season 2

The first episode of S2 was better than I expected

- Mar 22, 2003

- 28,995

- 17,663

The first episode of S2 was better than I expected

Yeah it’s decent

- Jul 13, 2005

- 35,415

- 27,029

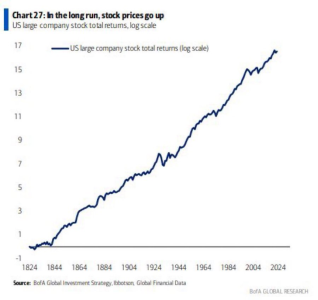

I don’t think this is a bull trap. Prices seem too low and oversold. The large consensus that this is a recession is overblown if every single person is talking about it and unemployment is up. Previous recessions weren’t this talked about until it blindsided us.

- Aug 22, 2012

- 8,764

- 7,551

I think a common mistake is people indexing YOY when they really should be comparing to pre-COVID metrics

- Dec 23, 2009

- 30,363

- 21,941

No. Stop it. I've been begging for a market correction and housing crisis for 5 years. Don't stop it from happening now when we're SO close!I don’t think this is a bull trap. Prices seem too low and oversold. The large consensus that this is a recession is overblown if every single person is talking about it and unemployment is up. Previous recessions weren’t this talked about until it blindsided us.

But even if everybody is talking about it, JPow will make sure a recession is here by next year. His plan (lol) is to guide the entire economy into a "light" recession and then start the money printer again to get spending going while inflation is in their target range.

- Jul 13, 2005

- 35,415

- 27,029

What if companies keep making money and those that are laid off get another job quick or don’t want to work anymore?

The black swan event we are looking for is a imagination. We just had one 3 years ago. We can bring up Russia, China, etc but that’s not tanking the market the way we would want it to.

I just don’t see it if the above holds true.

The black swan event we are looking for is a imagination. We just had one 3 years ago. We can bring up Russia, China, etc but that’s not tanking the market the way we would want it to.

I just don’t see it if the above holds true.

- Dec 23, 2009

- 30,363

- 21,941

Then Powell's dreams of a light recession will come true. If corporate earnings keep increasing then people who are laid off will be able to replace their income quickly; if the earnings slow down because govt or B2B spending slows down (in conjunction with higher interest rates) then labor replacement will slow.What if companies keep making money and those that are laid off get another job quick or don’t want to work anymore?

The black swan event we are looking for is a imagination. We just had one 3 years ago. We can bring up Russia, China, etc but that’s not tanking the market the way we would want it to.

I just don’t see it if the above holds true.

People won't want to go back to work for lower wages, but when the bills come due, perception changes fast. So we hope inflation is slowed way down before the layoffs and lower avg wages start coming in. Thats the "light recession" JPow wants.

If he misses, and inflation doesn't slow down enough, the increase in unemployment and lower wages will cascade into bankruptcies and lost wealth. The fed stopped the literal one thing that was floating the economy for 2 years. GDP is down 1H22, so technically we're in a recession, and reality will catch up soon.

Layoffs are coming. Spending has slowed. Debt is defaulting. Companies will start failing soon. Sometimes all it takes is one.

- Jul 27, 2013

- 12,095

- 14,916

The hubris of trying to engineer a soft landing recession.

They'll prolly Slow rate hikes till Sept then pause or even cut rates into Election Szn which is the start of Santa Rally Szn. Tom Lee/DTepper rip your face off rally setting up.

They'll prolly Slow rate hikes till Sept then pause or even cut rates into Election Szn which is the start of Santa Rally Szn. Tom Lee/DTepper rip your face off rally setting up.

- Aug 19, 2015

- 8,320

- 7,173

Not sure how much economic clout this guy has, but he has been suggesting things are going to get worse here shortly. Few other tweets that he's replied to and retweeted:

- Dec 23, 2009

- 30,363

- 21,941

You dont think Sept has another 75 or 100bps hike? Especially if inflation doesn't slow and hiring/employment holds up?The hubris of trying to engineer a soft landing recession.

They'll prolly Slow rate hikes till Sept then pause or even cut rates into Election Szn which is the start of Santa Rally Szn. Tom Lee/DTepper rip your face off rally setting up.

Personally I dont see JPow slowing rate hikes if employment data and inflation keep holding steady (i know a lot can happen in 2 months tho). If he does slow the hikes to 50, or god forbid 25 bps, the markets probably will rip.

Now, if we do keep ripping, I'm okay with that too. Just need the housing market to **** itself before June next year. Sooo lets get a recession tee'd up and smack it into action in January

- Jul 13, 2005

- 35,415

- 27,029

I’m willing to bet anything they won’t hike over 75. My bet is 50-75 for sure.

- Jul 27, 2013

- 12,095

- 14,916

My bet is .50 in sept. They'll cite falling inflation #s, cheaper gas, cheaper chicken wings, etc...Mission Accomplished(gwbush).You dont think Sept has another 75 or 100bps hike? Especially if inflation doesn't slow and hiring/employment holds up?

Personally I dont see JPow slowing rate hikes if employment data and inflation keep holding steady (i know a lot can happen in 2 months tho). If he does slow the hikes to 50, or god forbid 25 bps, the markets probably will rip.

Now, if we do keep ripping, I'm okay with that too. Just need the housing market to **** itself before June next year. Sooo lets get a recession tee'd up and smack it into action in January

Fed will need to pause/cut rates and QEv.10 to keep this econ afloat (japanonomics101).

Need a blow off top for true recession hits.

- Mar 22, 2003

- 28,995

- 17,663

Please have dry powder ready boys - been prepping you with this narrative for a minute, no excuses

Last edited:

- Sep 30, 2006

- 15,804

- 12,202

Yall got anymore of them pox stocks

Bought some $bvnry, might do some calls on $adpn or is it too late

Bought some $bvnry, might do some calls on $adpn or is it too late

Last edited:

- Jul 27, 2013

- 12,095

- 14,916

Yall got anymore of them pox stocks

Bought some $bvnry, might do some calls on $adpn or is it too late

NanoViricides Reports That It Has Begun Drug Development to Combat Monkeypox Virus

Similar threads

- Replies

- 111

- Views

- 17K

- Replies

- 22

- Views

- 2K

- Replies

- 38

- Views

- 4K