*Consistency- always add money in. At least 10 a week until you get a rythym.

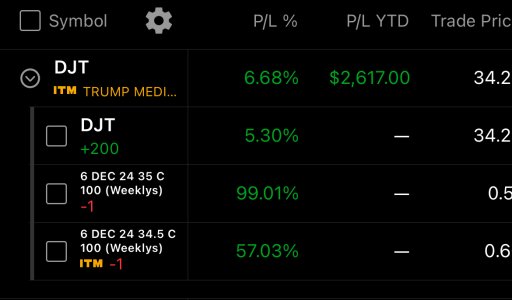

*Game plan- whether you like option, divs or growth stocks stick to it. Find out what you like.

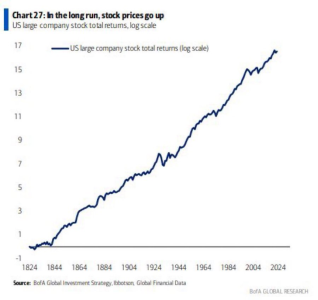

*As Anti mentioned, time in the market> timing. I once bought some BTC when it was at 7k. Now it’s in the 50s. You can never time it. Investing is a long game. NVdA is another good one. One day it’s in the 150 all of a sudden it’s selling for 700.

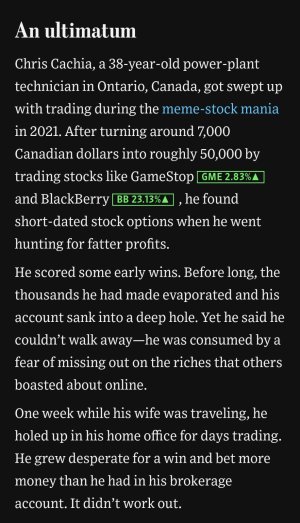

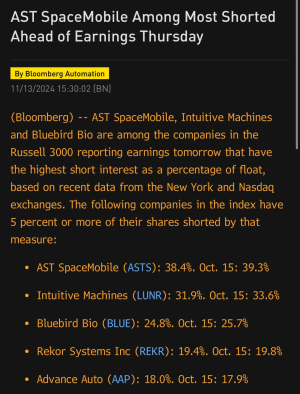

*Don’t be scared to fail. There’s gonna be stocks that you think should do well but are trash. I always thought Disney was a powerhouse, but the stock is pretty trash. How much more can Disney grow and create revenue. Tho, it is doing better now.

*Read. Always something new to learn. Share portfolios. Anytime I see the homies portfolio makes me want to hustle even more.