- 500

- 228

- Joined

- Nov 29, 2002

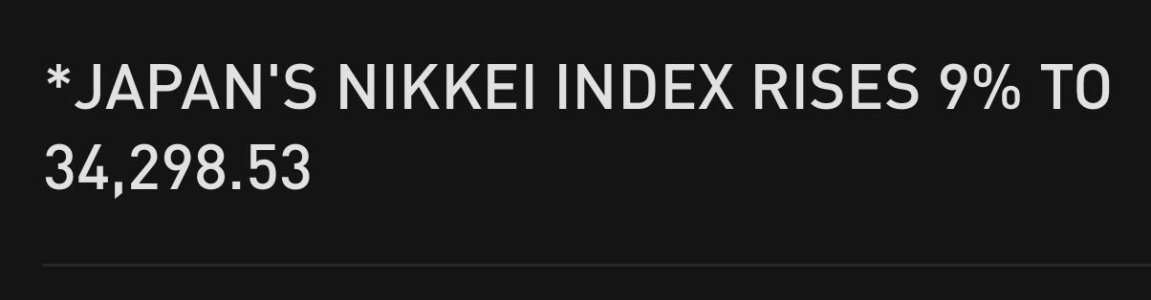

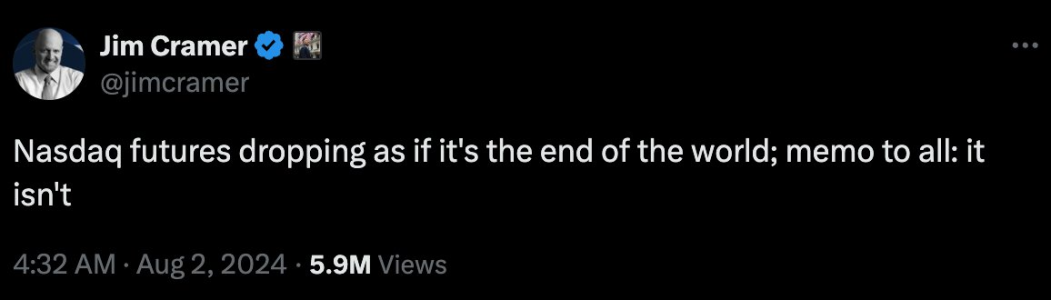

This market is punishing recklessness finally. Patience is more important now than ever. I'm getting smoked from being exuberant and jumping in too early on these dips.

You are speaking gospel. Every time i think im buying the dip..........the next day its a harder dip.

I hate this market.

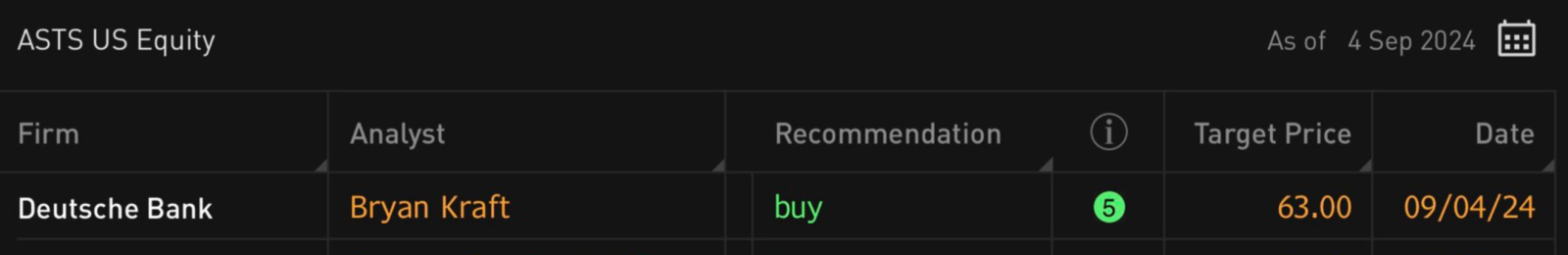

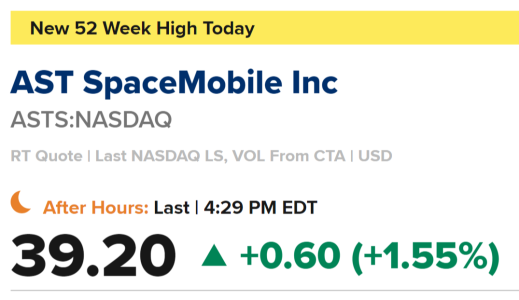

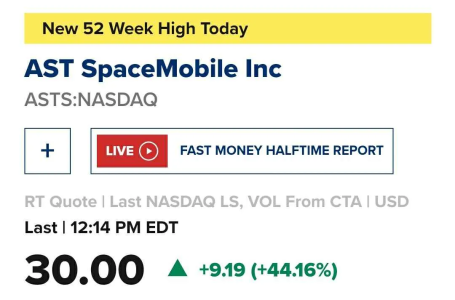

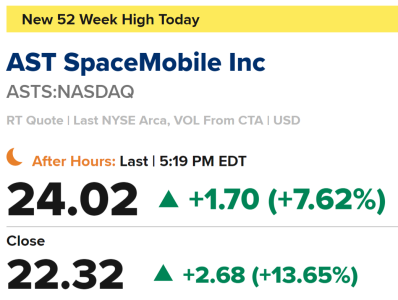

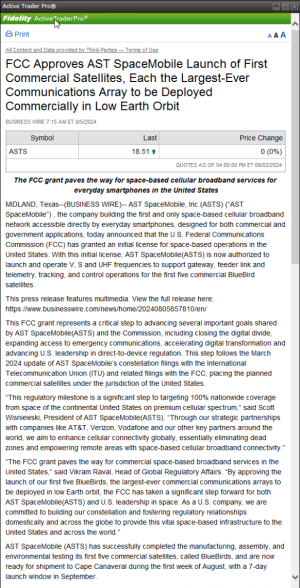

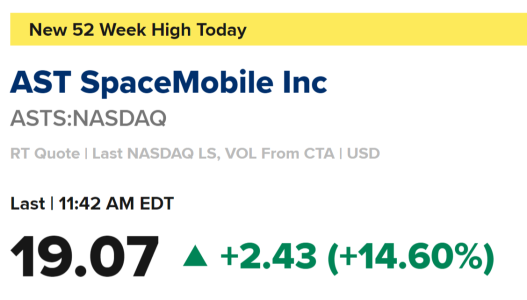

I hate this market. Happy I added to that yesterday.

Happy I added to that yesterday.