some Options tests and material to learn from

https://www.cboe.com/learncenter/default.aspx

just use TOS OnDemand at night and fool around with options on there during your free time so you get a feel. i suggest you just fool around on there in general for the next year during your free time. stick to the dollar amount you'd be using in real life and slowly increase size.

learn your greeks, most importantly theta. most people blow out because they aren't privy to time decay. front month options are cheaper than back month because of theta. back month, you have more time value, front month is less and if there isn't intrinsic value, they're designed to go to 0.

front month is one month or two out from your current day (Jan 17 exp)

back month is two months or more out from your current day (March, April, June exp)

learn about implied volatility. it's probably the most important thing to learn next to theta. vol crush is very real after catalysts/earnings reports/volatile days in the market.

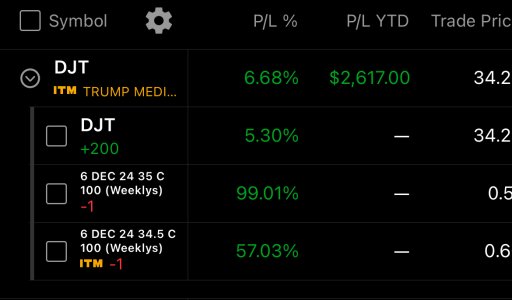

stay away from swinging weeklies. weeklies are high in gamma so they offer your best return, but your greatest risk. i day trade weeklies but i wouldn't swing them unless it's in a spread or if i have freebies (sold half at a double or more) and i'm looking for a continuation move the next day (or i would do a small dollar amount i don't mind losing). i wouldnt touch weeklies if i was you with real money, but have fun using Tos OnDemand or paper trading with them so you can learn from your mistakes without losing capital. i love weeklies in all honesty but they're not for beginners, they're designed to go to 0 every friday if they're out of the money.

on a 10 lot, every 10 cents is 100 bucks so your dollar amount is vastly different from common stock. a 10 lot is equivalent to 1000 shares.

avoid sell options naked. you have blow out risk that way. always spread them if you wanna capitalize on theta and look to do credit spreads that offer even money bets or better. also make sure you manage your spreads/options on expiration (if you're in the money) or else you'll be assigned stock.

Friday's a new year so i'll be doing new spread sheets after the close for FB, AAPL, TWTR, BABA and maybe TSLA to try and stay on top of them and their habits. With the spreadsheet from this year, I knew TWTR's tendency to go green/red and I could use that data to either look for late day fades, or close out long positions that look heavy. There's a basic template for TSLA in the OP with the formula. I'll try and remember to post them in here after I do it.

just study up and paper trade them. Have nothing to lose messing around on the simulator.

just study up and paper trade them. Have nothing to lose messing around on the simulator.