1. Always have a plan going into the trade. Know your entry level, stop and target.

2. Keep losses small and wins big. We embrace small losses. A small loss or big gain means you are doing it right. Winning traders do not have small wins and big losses.

3. Your reward to risk ratio, determined by your target and stop, should be no less than 2:1

4. Know the simple formula to calculate reward to risk ratio: (Target-Entry)/(Entry-Stop)

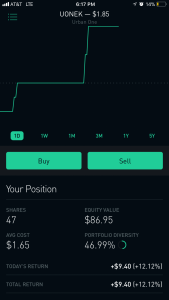

5. When deciding on position size, focus on amount risked rather than percentage of your account. The amount risked is the potential loss (Entry price-Stop price)*shares. The amount risked should not be more than 2 percent of your account, preferably .5-1 percent.

6. Your target and stops should be determined by support and resistance levels, along with your risk ratio.

7. Stick with your target and stop once in a trade. Do not micro-manage your positions. Set it and forget it.

8. Set hard stops if you can’t watch the stock during the day.

9. We are traders, not stock pickers. Focus on risk and trade management, along with the setup.

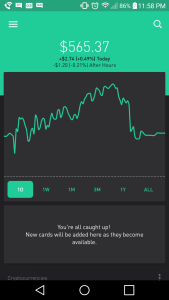

10. Pay attention to the overall market when trading individual stocks. This will help you determine the overall bias of your portfolio.

11. Keep it simple. Use no more than 2 indicators on a chart. Indicators only reflect what we see in price and volume.

12. Bullish stocks should have a good volume pattern showing accumulation. This means volume on up days should outpace volume on down days. Bearish stocks should have a negative volume pattern showing distribution. This means volume on down days should outpace volume on up days.

13. The four keys to a setup are price pattern, volume pattern, support levels and resistance levels.

14. Use RSI to look for divergences at major pivot points and highs/lows. Use stochastic as an overbought/oversold indicator.

15. Moving averages provide strong support and resistance, and help identify trends

16. Small account holders, don’t worry about how “expensive” a stock is or how many shares you can buy. A volatile $300 stock that moves 10 percent is better than a $3 stock that moves 5 percent, regardless of your position size. Focus on percentage gains, not point gains.

17. Many factors go into my making a trade. If I don’t trade a focus list stock that hits it’s buy point , that does not mean it’s not a valid setup. It could be that I am over invested, have too many longs in a bearish market, or just taking a nap. Ultimately you are responsible for your trades. Do not rely on me.

18. Breakout pullbacks should be orderly with small price moves on the pullback and on low volume.

19. When I call something a “speculative trade”, it is just that, a toss up “gamble”. Trade it smart with good risk management, but know that anything can happen. If you can’t handle it, don’t trade it.

20. Have your focus list ready to start the trading day. Write down your entry,stop and target levels. A great free tool to keep a small watchlist is Finviz.

21. Every pattern is a breakout/breakdown, bottoming/topping or countertrend “reversion to the mean” setup. It doesn’t matter if it’s called a flag, pennant, rubberband or W bottom. Know the underlying action, not the terminology.

22. Understand that these patterns we trade are based human nature, fear and greed. We track and follow the big money. Never lose sight of what these patterns represent.

23. Keep a trade journal and study your trades at least once every quarter.