- 12,259

- 12,016

but you are wrong papi.

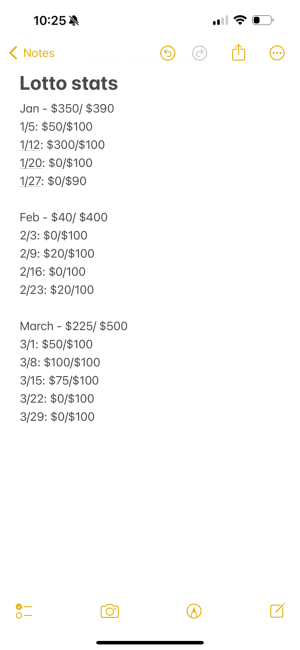

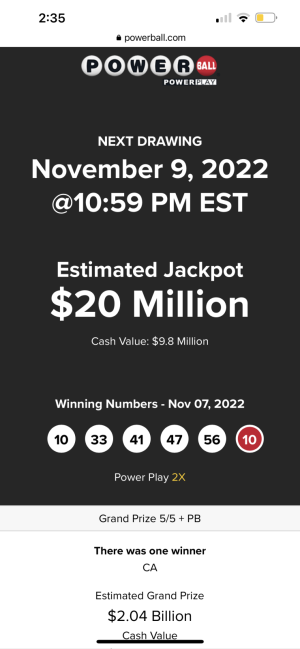

If you take a lump sum of 100Milli you'll need a interest rate of at least 3.85% to get 300Milli after 30years. Meaning the money would have to sit in an account collecting interest and compounding interest in order to beat out the annuity payment of 300mil.

Even by reading your comments think about it.

You making 1 million a year for 30 years to be able to make 30 million. While the annuity payment is 10Milli for 30 years.

So unless you are pulling 5% on Amy investment a year for 30 years I would go annuity. I said 5 cause I would need some of the interest to live.

Furthermore, if you was to collect 10MIL and put it in the same 3.85%account and subsequently put the annuity in the account every year, after 30 years that account would have 552Milli

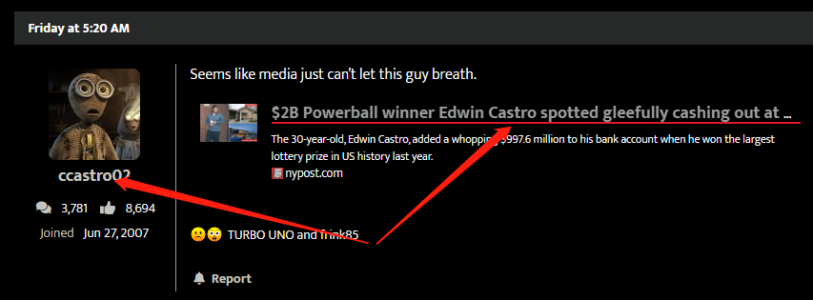

Why are you so focused on this money that you won't get if you take the lump sum.

I failed high school math and dropped out but eem I know the value of the dollar today is going to be worth more than tomorrow. That's simple economics.

If you take the lump sum there's so much more you could do with it than an annuity payment. Otherwise, that other way of thinking is how you stay perpetually broke.

my homeboy said the exact same sht yesterday. Talking bout he gon have Alexis Skyy and Phukd Phame on retainer

my homeboy said the exact same sht yesterday. Talking bout he gon have Alexis Skyy and Phukd Phame on retainer