dunno if posted but.

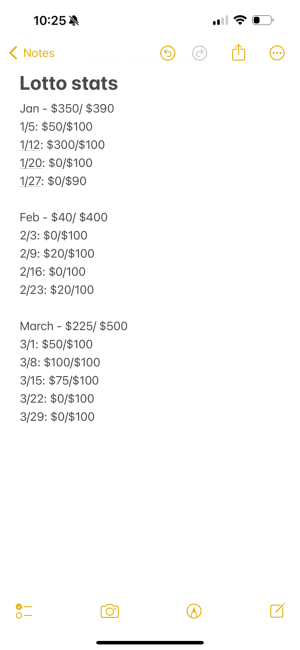

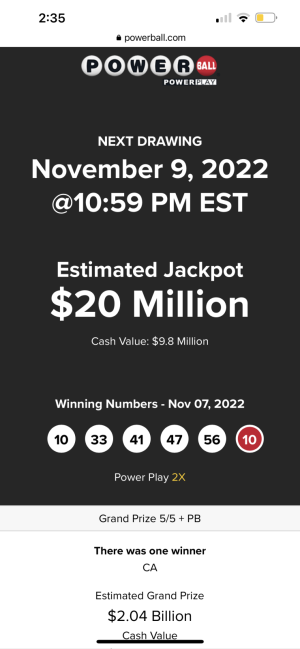

Numbers are for winning ~$650 mil.

So, what the hell DO you do if you are unlucky enough to win the lottery?

This is the absolutely most important thing you can do right away: NOTHING.

Yes. Nothing.

DO NOT DECLARE YOURSELF THE WINNER yet.

Do NOT tell anyone. The urge is going to be nearly irresistible. Resist it. Trust me.

1. IMMEDIATELY retain an attorney.

Get a partner from a larger, NATIONAL firm. Don't let them pawn off junior partners or associates on you. They might try, all law firms might, but insist instead that your lead be a partner who has been with the firm for awhile. Do NOT use your local attorney. Yes, I mean your long-standing family attorney who did your mother's will. Do not use the guy who fought your dry-cleaner bill. Do not use the guy you have trusted your entire life because of his long and faithful service to your family. In fact, do not use any firm that has any connection to family or friends or community. TRUST me. This is bad. You want someone who has never heard of you, any of your friends, or any member of your family. Go the closest big city and walk into one of the national firms asking for one of the "Trust and Estates" partners you have previously looked up on

http://www.martindale.com[1] from one of the largest 50 firms in the United States which has an office near you. You can look up attorneys by practice area and firm on Martindale.

2. Decide to take the lump sum.

Most lotteries pay a really pathetic rate for the annuity. It usually hovers around 4.5% annual return or less, depending. It doesn't take much to do better than this, and if you have the money already in cash, rather than leaving it in the hands of the state, you can pull from the capital whenever you like. If you take the annuity you won't have access to that cash. That could be good. It could be bad. It's probably bad unless you have a very addictive personality. If you need an allowance managed by the state, it is because you didn't listen to point #1 above.

Why not let the state just handle it for you and give you your allowance?

Many state lotteries pay you your "allowance" (the annuity option) by buying U.S. treasury instruments and running the interest payments through their bureaucracy before sending it to you along with a hunk of the principal every month. You will not be beating inflation by much, if at all. There is no reason you couldn't do this yourself, if a low single-digit return is acceptable to you.

You aren't going to get even remotely the amount of the actual jackpot. Take our old friend Mr. Whittaker. Using Whittaker is a good model both because of the reminder of his ignominious decline, and the fact that his winning ticket was one of the larger ones on record. If his situation looks less than stellar to you, you might have a better perspective on how "large" your winnings aren't. Whittaker's "jackpot" was $315 million. He selected the lump-sum cash up-front option, which knocked off $145 million (or 46% of the total) leaving him with $170 million. That was then subject to withholding for taxes of $56 million (33%) leaving him with $114 million.

In general, you should expect to get about half of the original jackpot if you elect a lump sum (maybe better, it depends). After that, you should expect to lose around 33% of your already pruned figure to state and federal taxes. (Your mileage may vary, particularly if you live in a state with aggressive taxation schemes).

3. Decide right now, how much you plan to give to family and friends.

This really shouldn't be more than 20% or so. Figure it out right now. Pick your number. Tell your lawyer. That's it. Don't change it. 20% of $114 million is $22.8 million. That leaves you with $91.2 million. DO NOT CONSULT WITH FAMILY when deciding how much to give to family. You are going to get advice that is badly tainted by conflict of interest, and if other family members find out that Aunt Flo was consulted and they weren't you will never hear the end of it. Neither will Aunt Flo. This might later form the basis for an allegation that Aunt Flo unduly influenced you and a lawsuit might magically appear on this basis. No, I'm not kidding. I know of one circumstance (related to a business windfall, not a lottery) where the plaintiffs WON this case.

Do NOT give anyone cash. Ever. Period. Just don't. Do not buy them houses. Do not buy them cars. Tell your attorney that you want to provide for your family, and that you want to set up a series of trusts for them that will total 20% of your after tax winnings. Tell him you want the trust empowered to fund higher education, some help (not a total) purchase of their first home, some provision for weddings and the like, whatever. Do NOT put yourself in the position of handing out cash. Once you do, if you stop, you will be accused of being a heartless bastard (or *****). Trust me. It won't go well.

It will be easy to lose perspective. It is now the duty of your friends, family, relatives, hangers-on and their inner circle to skew your perspective, and they take this job quite seriously. Setting up a trust, a managed fund for your family that is in the double digit millions is AMAZINGLY generous. You need never have trouble sleeping because you didn't lend Uncle Jerry $20,000 in small denomination unmarked bills to start his chain of deep-fried peanut butter pancake restaurants. ("Deep'n 'nutter Restaurants") Your attorney will have a number of good ideas how to parse this wealth out without turning your siblings/spouse/children/grandchildren/cousins/waitresses into the latest Paris Hilton.

4. You will be encouraged to hire an investment manager. Considerable pressure will be applied. Don't.

Investment managers charge fees, usually a percentage of assets. Consider this: If they charge 1% (which is low, I doubt you could find this deal, actually) they have to beat the market by 1% every year just to break even with a general market index fund. It is not worth it, and you don't need the extra return or the extra risk. Go for the index fund instead if you must invest in stocks. This is a hard rule to follow. They will come recommended by friends. They will come recommended by family. They will be your second cousin on your mother's side. Investment managers will sound smart. They will have lots of cool acronyms. They will have nice PowerPoint presentations. They might (MIGHT) pay for your shrimp cocktail lunch at TGI Friday's while reminding you how poor their side of the family is. They live for this stuff.

You should smile, thank them for their time, and then tell them you will get back to them next week. Don't sign ANYTHING. Don't write it on a cocktail napkin (lottery lawsuit cases have been won and lost over drunkenly scrawled cocktail napkin addition and subtraction figures with lots of zeros on them). Never call them back. Trust me. You will thank me later. This tactic, smiling, thanking people for their time, and promising to get back to people, is going to have to become familiar. You will have to learn to say no gently, without saying the word "no." It sounds underhanded. Sneaky. It is. And its part of your new survival strategy. I mean the word "survival" quite literally.

Get all this figured out BEFORE you claim your winnings. They aren't going anywhere. Just relax.

5. If you elect to be more global about your paranoia, use between 20.00% and 33.00% of what you have not decided to commit to a family fund IMMEDIATELY to purchase a combination of longer term U.S. treasuries (5 or 10 year are a good idea) and perhaps even another G7 treasury instrument. This is your safety net. You will be protected... from yourself.

You are going to be really tempted to starting being a big investor. You are going to be convinced that you can double your money in Vegas with your awesome Roulette system/by funding your friend's amazing idea to sell Lemming dung/buying land for oil drilling/by shorting the North Pole Ice market (global warming, you know). This all sounds tempting because "Even if I lose it all I still have $XX million left! Anyone could live on that comfortably for the rest of their life." Yeah, except for 33% of everyone who won the lottery.

You're not going to double your money, so cool it. Let me say that again. You're not going to double your money, so cool it. Right now, you'll get around 3.5% on the 10 year U.S. treasury. With $18.2 million (20% of $91.2 mil after your absurdly generous family gift) invested in those you will pull down $638,400 per year. If everything else blows up, you still have that, and you will be in the top 1% of income in the United States. So how about you not **** with it. Eh? And that's income that is damn safe. If we get to the point where the United States defaults on those instruments, we are in far worse shape than worrying about money.

If you are really paranoid, you might consider picking another G7 or otherwise mainstream country other than the U.S. according to where you want to live if the United States dissolves into anarchy or Britney Spears is elected to the United States Senate. Put some fraction in something like Swiss Government Bonds at 3%. If the Swiss stop paying on their government debt, well, then you know money really means nothing anywhere on the globe anymore. I'd study small field sustainable agriculture if you think this is a possibility. You might have to start feeding yourself.

6. That leaves, say, 80% of $91.2 million or $72.9 million.

Here is where things start to get less clear. Personally, I think you should dump half of this, or $36.4 million, into a boring S&P 500 index fund. Find something with low fees. You are going to be constantly tempted to retain "sophisticated" advisers who charge "nominal fees." Don't. Period. Even if you lose every other dime, you have $638,400 per year you didn't have before that will keep coming in until the United States falls into chaos. **** advisers and their fees. Instead, drop your $36.4 million in the market in a low fee vehicle. Unless we have an unprecedented downturn the likes of which the United States has never seen, should return around 7.00% or so over the next 10 years. You should expect to touch not even a dime of this money for 10 or 15 or even 20 years. In 20 years $36.4 million could easily become $115 million.

7. So you have put a safety net in place.

You have provided for your family beyond your wildest dreams. And you still have $36.4 million in "cash." You know you will be getting $638,400 per year unless the capital building is burning, you don't ever need to give anyone you care about cash, since they are provided for generously and responsibly (and can't blow it in Vegas) and you have a HUGE nest egg that is growing at market rates. (Given the recent dip, you'll be buying in at great prices for the market). What now? Whatever you want. Go ahead and burn through $36.4 million in hookers and blow if you want. You've got more security than 99% of the country. A lot of it is in trusts so even if you are sued your family will live well, and progress across generations. If your lawyer is worth his salt (I bet he is) then you will be insulated from most lawsuits anyhow. Buy a nice house or two, make sure they aren't stupid investments though. Go ahead and be an angel investor and fund some startups, but REFUSE to do it for anyone you know. (Friends and money, oil and water - Michael Corleone) Play. Have fun. You earned it by putting together the shoe sizes of your whole family on one ticket and winning the jackpot.

, guess my minor in math did me well.

, guess my minor in math did me well.