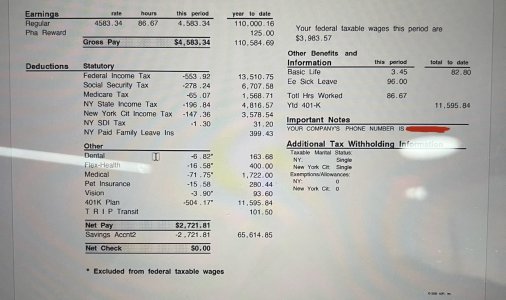

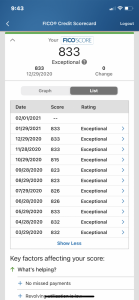

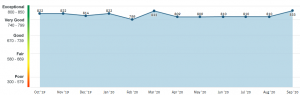

- 3,667

- 2,457

Does anyone know if the below companies use soft pulls?

BOA

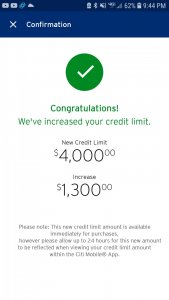

CITI

Chase

Chase is a hard pull no matter what. Only way to increase a limit with chase without a hard pull is to transfer some or all of your limit from another chase card to the one you want to increase. Not sure about the others, would like to know about citi