- 912

- 456

- Joined

- Sep 23, 2012

I have a question a friend asked, that I didn't have an answer for, that maybe someone here does:

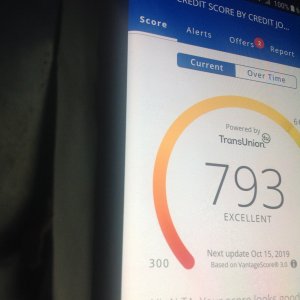

My friend has an AMEX and he has a good payment history (never late, doesn't let amounts build, etc). At the time he signed up the card, he was in college in LA, so he had no job, but they awarded him the card with a 10K limit based off his already established credit. He put his income at 30K which he told me was money he was getting from school & just other assets he calculated.

Now, he wants to raise his credit limit to improve his credit score since he will keep the same usage but the credit utilization will be where it should be since he has a higher limit, but in order to be successful at getting this he has to update his income with them, but due to the pandemic and other factors he still doesn't have a job, so he doesn't have a source of an income currently.

If he updates his income & puts something higher, will AMEX look into this? Are there ways to update credit limit without bringing up annual income with AMEX?

He doesn't want a higher limit to spend more, but just to improve his score. He's a very responsible person & not a crazy spender, but he was asking me what AMEX does when you update your income & I personally didn't know given his situation. I told him to just wait until he found a new job, but it's been about 2 years for him.

Thanks if anyone has any knowledge on how to approach this.

PO

It's not good to lie but I doubt that will cause any problems. Especially if he hasn't requested an increase in the last 6 months. Credit card companies may be a little stingy with credit increases due to Covid.

) and my income grew gradually. If you're gonna lie, don't do anything crazy to give them any reason to look into it further, and don't request too much of an increase if you can't legitimately back it up.

) and my income grew gradually. If you're gonna lie, don't do anything crazy to give them any reason to look into it further, and don't request too much of an increase if you can't legitimately back it up.