- Oct 24, 2010

- 94,462

- 33,525

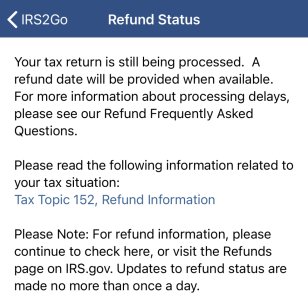

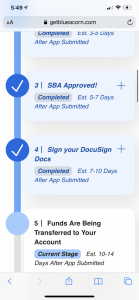

I had to amend for investmentsI thought they said there was no reason to amend, they are aware and would take care of it. Was actually told amending would take longer than waiting for them to distribute in May.

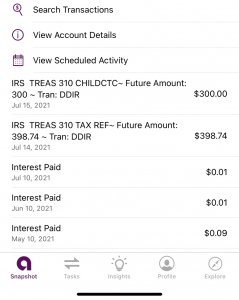

they came in late although I lost money

they came in late although I lost money