- 26,442

- 37,819

- Joined

- Jan 12, 2013

I checked my investment fund and I'm only down around €2k from yesterday so that's nothing.

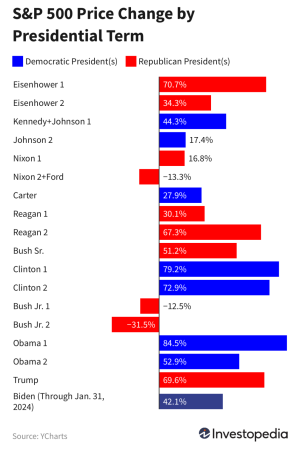

During the Trump admin I lost 20k despite my investment profile being set to defensive. During the Biden administration my outlook was looking green and I recovered the 20k back to my initial deposit, minus the 2k loss today.

If you're worried, go talk to your bank manager, read what impartial economists are saying/doing, ... instead of just relying on politicians likely vastly overstating the issue or minimizing it depending on their leanings.

During the Trump admin I lost 20k despite my investment profile being set to defensive. During the Biden administration my outlook was looking green and I recovered the 20k back to my initial deposit, minus the 2k loss today.

If you're worried, go talk to your bank manager, read what impartial economists are saying/doing, ... instead of just relying on politicians likely vastly overstating the issue or minimizing it depending on their leanings.

everything is easy in retrospect.

everything is easy in retrospect.