- 20,310

- 10,181

- Joined

- Jul 29, 2001

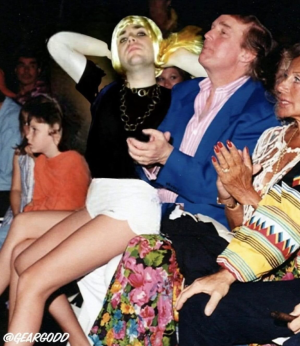

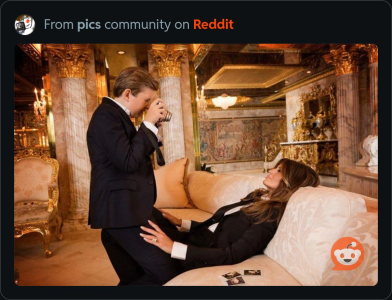

Wait who owns the Epstein plane now and how did the Trump campaign come to chartering it?

There are multiple planes. The one Trump is using is apparently not THE plane everyone is thinking of. At least, that's what I read.