- 60,034

- 50,947

- Joined

- Dec 14, 2004

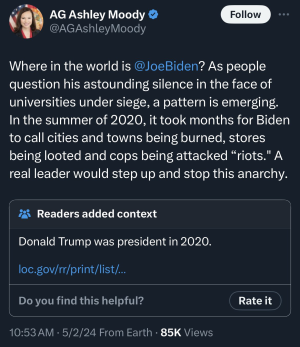

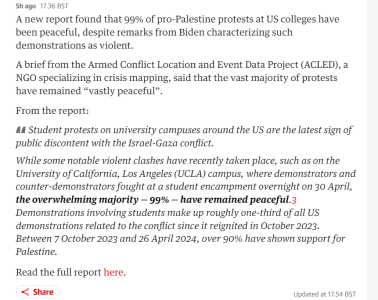

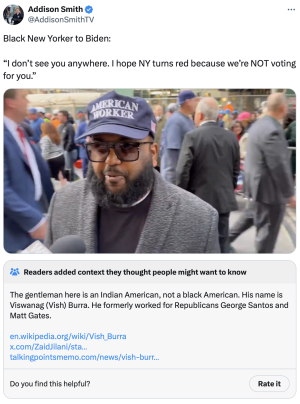

50 a super clown for that. No explanation or nothing. Rednecks all worked up and excited in his comments.

www.investopedia.com

www.investopedia.com

Biden’s Tax Plan: What’s Enacted, What’s Proposed

Here’s how the Biden administration’s recently enacted tax law changes—and new corporate and individual tax proposals—do (or could) affect taxpayers.