- Sep 30, 2006

- 15,804

- 12,202

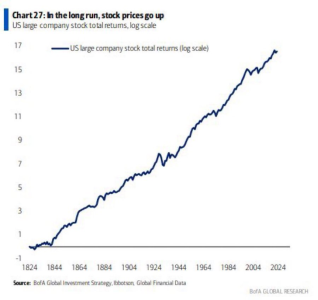

I didn’t know this bloodbath was going to be so drawn out.

I really wasn’t interested in the market pre2020. So I never experienced previous crashes or bear markets. I saw that covid flash crash that recovered so damn fast, and in the back of my mind had the mentality of “you can’t time the market. Time in the market >”.

We knew rate hikes were coming and the ARKK type growth companies were going to get beat down, I just thought maybe they’d rip the bandaid, valuations would correct quickly and we’d be on our way. Like trying to time an exit and re-entry would be foolish.

In hindsight, just should’ve went all cash in November at the least, if not even shorting the F out of growth. Now I’m still wondering if it’s not too late to go all cash and buy back our highest conviction names at a lower entry. Only like 8 months late on that so idk if it’s too late to bother. I did raise some cash over the past few months but not even close to enough. Like why am I still holding shares if I know it’s going lower??

Just keep loading up

Think of this as DS OG Chi 1’s going for almost retail when they originally released in 1985

This is a mega sale, keep buying and dont pay no mind to the news or the red

This is where thousandnaires/millionaires are made