antidope

Supporter

- Jan 2, 2012

- 63,806

- 68,675

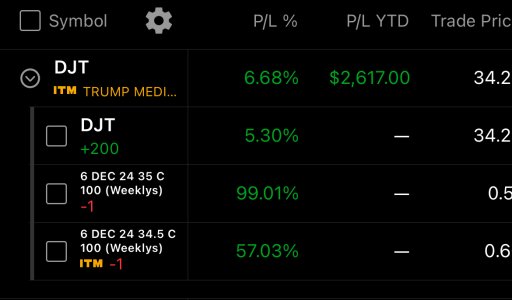

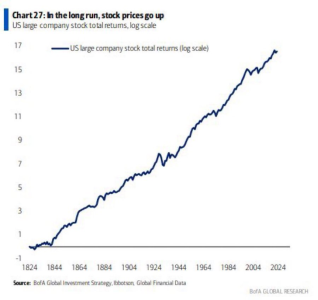

Did half. CPI next week so want to hedge against that running hot which it likely will cause it's summer.About to sell the VOO in my Roth and buy some NVDA and Meta.

Feeling like I don't need any more index exposure outside of my 401k