Finals are over so I'm back for all you people who keep incessantly e-mailing and messaging me about losing your life savings in FAZ with no stops.

Sparknotes for the morons who want to put money in stocks off an online stranger's suggestion without even bothering to read, much less understand, the thesis behind it:

Mr. Market is about to sell off hard and volatility is about to spike. This is no new bull market and the economy hasn't yet turned around even in nominal terms. Banks are still insolvent and overlevered and this rally was a scam to pass off asset depreciation onto the taxpayer. This rally is little more than a Ponzi scheme premised on unsustainable, one-time, illegal revenues.

LONG: ultrashort ETFs, T-bills, a little gold, volatility. SHORT: banks, insurers, REITs, airliners, long bonds, liquidity.

I'm also bullish on capitalism/free markets, Paul Volcker, Alexander Hamilton, sustainable growth, liberty. And bearish on socialism/government intervention, bank-government collusion, Bush + Greenspan, Obama + Bernanke + Geithner, asset bubbles/Ponzi schemes, theft.

The higher and longer we rally, the more bearish I get. This rally is a technically-driven quant deleverage-driven unsustainable bounce that will be met with massive volume selling into a highly illiquid market. Expect volatility to spike and the market to hit free fall mode. I work as a global macro equity analyst for a large asset management firm with a well-known quant arm. I won't/can't name it, but word is it's facing MASSIVE losses and is opening up itself to new investors for the first time in several years, adding more credence to the thesis. Remember, this is a market-neutral, down big in this rally. Quant methodologies are getting whipsawed.

I'll start this thread out with one of the latest posts on my

blog...

The S&P 500 is now up 31.0% since off of its March 6 lows around 666. Europe's Dow Jones Stoxx 600 Index has

broken even YTD. But since the

announcement of the Public-Private Investment Program (PPIP) on March 23, the equity market's rally has been defined by a rising channel on low volume. There have been no high-volume breakouts, the channel-defined uptrend's slope is very low, and the market has trended approximately sideways since April 9.

Readers may notice I mentioned the possibility of a rally to Dow 9000 back around the PPIP announcement. I mentioned this because if the Fed and Treasury were intent on printing our way out of this starting as soon as possible, their combined price-inflating powers would be unstoppable. There is no check or balance to the Federal Reserve and there has never been an audit of its balance sheet.

However, since the PPIP's announcement, the equity market has not shown traditional bullish technical movement. A slow ascending channel on low volume indicates a sloppy, bleeding market to the upside, nothing more than a setup for big downside action. Also, gold went down since the PPIP's announcement, which didn't add confluence to the price-inflating thesis behind the Dow 9000. This is why I turned bearish on the market, expecting a drastic sell-off, possibly to March lows and maybe below.

With such low volume, how is this market continuing its slow, yet upward ascent? Quant fund deleveraging has become the reason of choice to which this market movement has been attributed. Quants tend to short stocks with weak fundamentals and relative weakness versus indices, and quant deleveraging should manifest in weak stocks seeing dramatic share surges as quants scramble to cover shorts to lessen market exposure. And that's exactly what's happened. Stocks like

XL Capital (XL),

American Capital (ACAS),

Vornado Realty (VNO), and

Liz Claiborne (LIZ) showed massive rallies since March lows, leading the market and far outpacing stronger, more fundamentally-strong stocks, even ones with high beta. Even

Crocs (CROX) enjoyed a 50DMA breakout. This is highly indicative of a "short squeeze" bear bounce, rather than a sustainable bottoming rally, which is characterized by

new market leaders and sectors showing relative strength against previous leaders and breaking out of tight bases formed over several months.

Even if perennial short candidates are being squeezed, why? Why are quants deleveraging so quickly into this rally? It seems like the initial rally ingiters caught quants (and reality in fact) surprised. I am of course talking about the

Citigroup (C),

Bank of America (BAC), and

JPMorganChase (JPM) memos/releases announcing returns to profitability for the banks. Then came the earnings reports to back them. As many of you know by now, these announcements were all a load of hot air, as illegal

AIG (AIG) wholesale portfolio unwinds financed the one-time "fixed-income trading" revenues that boosted all of the earnings and FASB accounting gimmickry allowed writedowns to take a minimal cut from positive surprises.

On top of that, however,

Zerohedge pointed out the

significant role Goldman Sachs (GS)'s program trading arm is having during this rally. With 1 billion shares principal traded becoming a weekly regular for Goldman and its principal/customer facilitation+agency maintaining a ratio above 5x, Goldman has been massively increasing its participation (in its principal trading, at that) while other quants and prog trading arms are quickly deleveraging. The conspiracy theorist in me wants to say the Fed/PPT is throwing kool-aid capital at the market through administration girlfriend Goldman Sachs to drive up the market and force short covering. Of course, this is timed perfectly, as banks offer BS earnings reports financed by illegal AIG transactions aided and abetted by the Fed and Treasury. But of course, only the conspiracy theorist in me would ever dare make such an assertion.

As a recap, this rally starts primarily with the AIG unwinds. AIG was

bailed out by the Federal Reserve in September 2008 as its bankruptcy was deemed a systemic risk because of AIG's massive counterparty obligations in the CDS arena. The liquidity extended by the Fed to AIG was meant to allow CDS settlements to counterparties at significant haircuts, but with enough payment to prevent a systemic crisis. But were haircuts taken or were these trades settled at 100% face value with massive profits to counterparty banks? Former New York Attorney General Elliot Spitzer clearly seems to think not, as he wrote in his terrific article

The Real AIG Scandal. All of the hooplah has led TARP's inspector general Neil Barofsky to

launch an investigation into the extent of contract settlement repayments.

Bank of New York Mellon (BK) missed earnings estimates by $0.10 in the middle of amazing Q1 numbers from the other big banks. Such is the result when you aren't eligible for AIG counterparty money. Especially interesting is Goldman Sachs's counterparty relationship to AIG, an issue delved into as early as last September itself in the the

NY Times.

But I digress. The AIG CDS unwind trades were allowed by

new trade protocols given by the IDSA, the only regulator of the OTC CDS market. In turn, these massive unwinds (financed by the taxpayer, who paid for the initial AIG bailout and all credit lines extended since) yielded huge one-time profits for banks, who flaunted them like no tomorrow. After releasing memos (the first of which was from Citi on March 10, the rally's first day) asserting first-quarter profitability, banks saw huge rallies in their stocks. At this point off of the lows, the rally was merely an oversold bounce and its sustainability was very much in question. Looking back, any sideline capital that was infused into financials on the news of these memos was misallocated, as the memos presented one-time illegal gains as indicators of sustainable turnarounds in bank earnings.

The market rallied on the news and started selling off around S&P 800, at January cycle lows and index 50DMAs. This is where I expected the rally to end, as previous support (January lows) tends to offer resistane once broken and important moving averages like the 50DMA offer important buy/sell points, depending on the market.

Then came news of the PPIP and the market once again soared. Since then, the market has rallied just over 6% on very low volume. This is where the quant dislocation comes into play. Quants, who make market-neutral high-frequency scalp trades on leverage to produce returns, were caught short in a strong rally. Again, the rally itself was initially catalyzed by bank announcements that attempted to present unsustainable profits as sustainable, so the rally in effect of the news would also be just that-- unsustainable. But the quants were forced to deleverage into the rally as their models were getting whipsawed by the unusual market activity. As they deleveraged and covered short positions in weak stocks and were forced to hedge their delta by taking bullish positions, this added fuel to the rally, which caused more deleveraging, and so on. This is evidenced by Renaissance's recent underperformance against the S&P by 17%, as well as a possible reason for the

possible unwinding of Morgan Stanley's PDT arm. A recent

WSJ article even claims quants are "brewing trouble" over at Morgan Stanley.

So where is the breaking point? A look into the

why instead of

how of this rally can offer some insight. This whole rally is essentially a scam to pass off asset depreciation in struggling financials to the taxpayer. The AIG counterparty profits were all taxpayer-financed. The PPIP's leverage is taxpayer-financed. But the real issue is the equity raises in this rally. Goldman announced an

equity sale with its earnings a day after pre-announcing earnings. This is $5 billion of Goldman equity being traded for $5 billion of the public's cash on misconceived presuppositions of sustainable profitability. REITs have been offering shares all over the place, and conspiracies of their own have developed between the connection of JPMorganChase and Merril Lynch/Bank of American analysts and the REIT secondaries these banks have been underwriting.

Also, the recent surge in Goldman principal program trading starts to take some context here. If Goldman's program trading arm has been feeding into the rally and forcing quant deleveraging, then this explains why-- so it can raise cash by selling stock. Which I

predicted and which indeed occurred. It'd be interesting to know how much of Goldman's $5B have been raised at these scam-inflated prices ($123/share I believe was the going price for the secondary). As soon as it's "finished," I fully expect GS's 5x principal/customer facilitation+agency ratio to fall off a cliff. On top of the equity sale, Goldman also

just sold $2B in bonds, just days ahead of stress test results. Again, the timing is very strange. In a terrific article entitled

Goldman's Offering and Recent Rally: Coincidence?, Ben El-Baz states

"although there is no hard evidence that Goldman intentionally hyped up the market rally and the financial sector to get a better price on its offering, it would be very naïve to assume that they passively let the market determine the price of this massive dilution." This principal trading participation is the circumstancial evidence I'm sure he would love to see to back up his thesis.

Technically, the rally should end when quant deleveraging catches up with the rest of the market. That is, when the slow-money directional trend-setters deleverage their long buy-and-hold positions into the rally at a higher pace than the fast-money liquidity-providing quants do. This should occur at important inflection points where lots of supply is offered, otherwise known as resistance levels. I have been pointing out S&P 875 as a significant resistance level that might mark the rally's top and so far it hasn't been able to breach that level past a few points on no volume.

The selling/deleveraging into the rally has already started and should start picking up on volume soon. According to Washington Service, NYSE listed company

insiders have been selling into this rally at the fastest rate since October 2007. Insiders sold over $8 for each dollar they purchased of stock in the first three weeks of April. To give that some context, the

S&P topped out on October 11, 2007 and declined 57% before hitting March 2009 lows. If everything is so peachy and keen in the market and economy, why aren't insiders buying or at least holding stakes in their own companies? Possibly because they recognize that the "green shoots" are just weeds.

When it does end, slower money participants will be selling into a highly illiquid market, due to the deleveraging quants (liquidity providers) have had to face in the last several weeks. This will cause a spike in volatility and failed trade executions and whipsaws galore. Reality will quickly return to the market and the AIG CDS unwind story may gain more exposure, especially through the work of Barofsky and Spitzer. This would damage the investment thesis of all those who bought banks on their memos or earnings announcements, which would erase a big part of their recent huge gains.

So who loses in this rally? The taxpayer of course. As bank equity is sold to the public into a rally financed by illegal and unethical uses of taxpayer funding. This is clearly all done with the full aiding and abetting of the Treasury and Federal Reserve, which has come under recent attack because of its

alleged involvement in forcing BofA CEO Ken Lewis to buy Merrill Lynch and hide the distressed bank's true dismal state of affairs from BAC shareholders. If Goldman's principal trading increase is indicative of PPT activity, that also is taxpayer money being funnelled into an unsustainable rally, this time through the intermediary of Goldman's program trading arm.

The memos, the earnings, the statements all say the same thing-- banks made money Q1 2009. They don't mention why-- because of AIG portfolio unwinds and accounting gimmicks. Clearly causing an unsustainable hype in the soundness of American banks will lead to an unsustainable rally in equities. And that's what is happening.

The United States

GDP contracted over 6% in Q1 2009, well worse than estimates. A flu outbreak characterized as an

imminent pandemic by the WHO is spreading across the world, with early targets at total losses estimated around $2-3 trillion.

General Motors (GM) announced its debt restructuring plan this week, met with sharp criticism and a

drastically different counteroffer from bondholers, suggesting Chapter 11 is in order for the struggling automaker. Chrysler is expected to

announce its own bankruptcy tomorrow. Even government stress tests, whose worst-case scenarios are tangentially worse than current economic conditions, suggest

at least six of the 19 banks tested need to raise more capital. The selling catalysts are all over the place, while the buying catalysts were one-time unsustainable profits.

After announcing $1.2 trillion of arranged agency and Treasury purchases in mid March, The Federal Reserve didn't announce anymore quantitative easing today, while keeping rates at all-time lows. Once markets sell-off and liquidity once again contracts, the Fed will have much more political capital left to be able to monetize much more of this ludicrous spending. Expect rates to rise from here (

TBT is a good play for that) until the next wave of deflationary deleveraging and equity selling allows the Fed justification for another big round of QE, again capping rates and inflating the Treasury bubble. Mortgage rates are at Greenspan levels. Clearly the powers that be are reflating a reflated bubble. From dot-coms to houses and now to Treasuries. What is all of this? Passing off asset depreciation to the taxpayer in the form of currency depreciation. Wait for the black swan in Treasuries to implode the bubble (which is currently inflating), rates to rise, and rampant inflation.

But I yet again digress. Looking at the market right now, it is approaching the apex between important resistance at S&P 875 and the support trendline of its ascending channel. After breaking its shorter term rising wedge, it has formed a bear flag, and is approaching a break of its channel trendline, which should send the market falling. Other indices show similar bearish patterns, with the Nasdaq approaching massive supply at its 200DMA. Several oscillators have indicated divergences lately, suggesting the market is ready for its next wave down.

A breakout of 875

on big volume would change things, possibly indicating the BS rally found a way to incite slow money to buy into the rally, perhaps bringing enough buying power in to confirm a sustained bull market (assuming the Treasury continues to spend and the Fed continues to print). Irrational exuberance has been evident in the markets before but the deciding factor that allows it to drive sustainable (at least for the 1-2 year time horizon) bull markets is the inclusion of slow-liquidity sidelined instutional directtional trend-setting capital in the rally. There is volume to direct the equity prices' ascent. That simply doesn't exist right now and premarket gaps up are responsible for a big part of the rally. For the rally to continue, even in the face of complete irrationality, it needs sidelined cash to come pummelling into equities. It needs large volume accumulation to drive directional trends. A low volume rally floating higher is not indicative of any of that.

I want to say here that I understand there is no arguing with the market. It is never "wrong" as only price pays. I share the opinion that the only "fair" price of a stock (or anything in the world) is its current price in the open market-- the intersection of supply and demand. However, that does not mean price trends that appear sustainable are sustainable. That does not mean market participants are always right in their trades or that their investment theses are "right." My point is that this current rally is unsustainable and the higher we go, the harder and more volatile the fall will be. The catalysts behind the rally were all BS and there is clear government-bank collusion to pass off losses to the taxpayer.

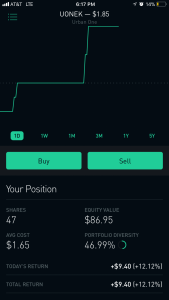

I leave you with charts of securities I see possible big trades in.

If you guys aren't fully caught up now after this post, quit trading-- you never will be.

PS for you gold bugs-- wait a month or two, next FOMC announcement in June should see more QE, expect some gold buying ahead of it and on it if there indeed is more quantitative easing (which I fully expect). Gold is a buy and hold, if you want to swing trade it, wait for the moves.

Gold a buy and hold from 2008 huh? Looking in hindsight if you didn't sell it at 1800-1900 you would have lost your opportunity. Gold is way to inconsistent to swing. I would buy gold when it hits less than 1000 and it seems like it will.