- Apr 4, 2008

- 74,934

- 24,348

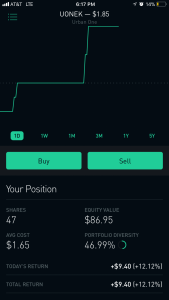

KOPN looks decent through 3.50. Has earnings August 4th though.

SBA

@StockBoardAsset

$KOPN Optics #AR/#VR Play on $LMT F-35 Fighter Program. Each Helment $160k. US Air dominance for the next K-WAVE pic.twitter.com/38XLGIVIZo

SBA @StockBoardAsset · 1h

$KOPN Ensuring American Air dominance through the next K-WAVE through Optics which enable true #AR #VR $VUZI $EMAN

I'm familiar a little with VUZI, virtual reality play similar to Occulus Rift currently trading on the OTCs. Gotta look into EMAN.

I'll be watching INVN this week. Think it might report this week so maybe it pulls back some. Wish I would've bought in the 18s few weeks back.

SBA

@StockBoardAsset

$KOPN Optics #AR/#VR Play on $LMT F-35 Fighter Program. Each Helment $160k. US Air dominance for the next K-WAVE pic.twitter.com/38XLGIVIZo

SBA @StockBoardAsset · 1h

$KOPN Ensuring American Air dominance through the next K-WAVE through Optics which enable true #AR #VR $VUZI $EMAN

I'm familiar a little with VUZI, virtual reality play similar to Occulus Rift currently trading on the OTCs. Gotta look into EMAN.

I'll be watching INVN this week. Think it might report this week so maybe it pulls back some. Wish I would've bought in the 18s few weeks back.