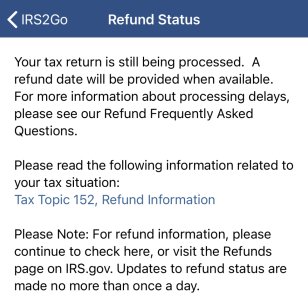

5 reasons you may not have gotten your stimulus money yet

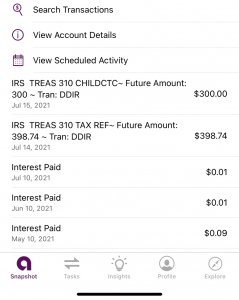

1. You didn't get a federal tax refund in 2018 or 2019

Even if you filed your 2018 or 2019 taxes electronically, that doesn't mean the IRS can direct-deposit the money into your bank account. You must have also received a refund in those years via direct deposit to get the money delivered automatically.

The IRS is not using bank account information it may have used to withdraw from your account if you owed money.

2. Your refund went to an old bank account

If you didn't receive a refund in 2019, or haven't filed yet, the IRS will use the bank account information used to send a refund for the 2018 tax year.

Some people told CNN that the money was sent to an account they have since closed and that the bank transferred the money back to the IRS. In that case, the payment will likely come later by a check in the mail.

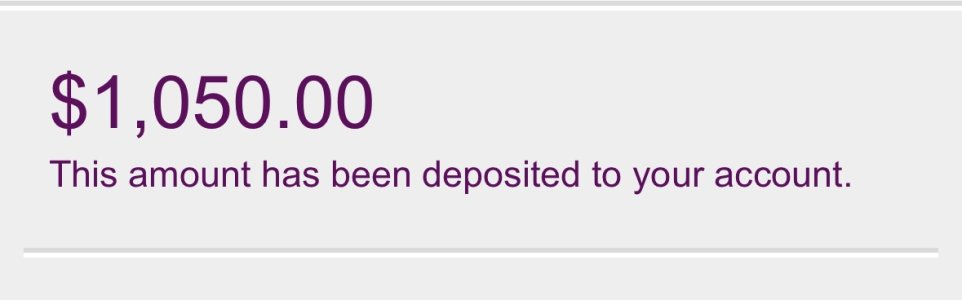

A new IRS online tool, called Get My Payment, allows you to input new bank account information -- but it's only helpful if the agency doesn't already have an account on file from a 2018 or 2019 tax return and hasn't yet processed your stimulus payment.

Filing a 2019 return now, if you haven't already done so, is the only way to update direct deposit information that the IRS has on file from a 2018 return.

Tax Day was moved from the traditional April 15 to July 15 this year to give filers more time.

3. Your refund went to a temporary account set up by a tax preparer

You may not even realize it, but sometimes tax preparers set up a temporary account and that's where your tax refund is deposited first. They take out their fees and then transfer the remaining money into your bank account or a debit card. Sometimes this is in the form of an advanced loan.

It may take longer for you to receive your stimulus money if that's the case. When stimulus payments were sent out in 2008, this glitch affected about 20 million people. But they eventually received the money by a paper check.

Some people who used popular tax preparers like TurboTax and H&R Block and received a refund on a debit card told CNN that the IRS tool could not confirm the status of their payment when they checked this week.

H&R Block said on its

website that it is still waiting for answers from the IRS, but that some people who have used its Emerald debit card will see their stimulus money transferred there.

TurboTax said the IRS has the appropriate banking information for all of its filers and that any of its customers who are eligible for a stimulus payment and had their refund transferred to a debit card will receive their payment without delays or fees.

4. You filed a paper return in 2019

Most people file electronically, but some still send in paper returns.

Amid the coronavirus pandemic, the IRS has many employees working remotely and has

stopped processing paper returns until its centers are able to reopen.

If you didn't get a refund directly deposited in 2018 and filed a paper return for 2019, you may be waiting for a paper check with your stimulus money.

5. You aren't normally required to file a tax return

There are millions of low-income people who are not normally required to file tax returns that will have to take some action before receiving their stimulus money.

Generally, these are individuals who did not earn more than $12,200 last year or married couples who did not earn more than $24,400.

But they won't have to file a whole new form, as earlier guidance from the IRS suggested. Instead,

it created an online tool for non-filers that asks for basic information including names, date of births, and Social Security numbers for the person filing and his or her dependents. They won't have to provide any income information.

The tool allows you to input bank account information for a direct deposit, or an address to receive a paper check.

I’m like hell no. It’s a classic and all but not worth that price.