Meanwhile, none of that work is well compensated. In the United States, according to the US Department of Education’s latest data, from 2011 to 2012, more than half of graduate students make less than US$20,000 a year. For reference, the federal poverty line for a single person without children is $12,060. Living in an expensive region such as Boston, Massachusetts, or the San Francisco Bay Area in California is especially tough. For example, graduate stipends at the US National Institutes of Health (NIH) are capped at $23,844 and are not adjusted for cost of living. To help out, universities often waive tuition fees, which can sometimes be more than a student’s income.

The last thing that graduate students need is a tax hike. But that is what many would face under a clause in the federal-tax-reform bill passed by the US House of Representatives last week. It will now need to be reconciled with the Senate’s tax-reform bill (which retains many existing student tax benefits), and signed by the president.

The 429-page tax plan — which President Trump reportedly tried to christen the “Cut, Cut, Cut Act” because it would ostensibly shrink taxes for many — would require students to report tuition-fee waivers as taxable income, moving the students into a higher tax bracket. Graduate students, who receive the lion’s share of tuition waivers, would be most affected. And 60% of the 145,000 students who get tuition reductions each year are working in science, engineering, technology and mathematics fields, the US Department of Education estimates.

The amount of money that the government would reap from these taxes would be minuscule, given the $20.5-trillion national debt. But it could weigh heavily on young scientists. Take a hypothetical PhD student at the Massachusetts Institute of Technology (MIT) in Cambridge, in receipt of a $23,844 NIH stipend. Under the current system, she would pay very little in taxes. The new law would add her $49,000 MIT tuition bill to her taxable income as though she were paid a $73,000 salary — an amount she never actually sees. This would add thousands of dollars to her tax burden.

This example is extreme — most graduate schools’ tuition fees are closer to $16,000 — but it is safe to say that many students could see their tax rate rise.

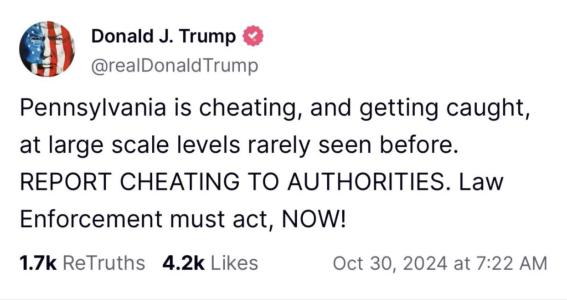

did Hillary appear on TV somewhere or something?