- 11,974

- 3,257

- Joined

- Dec 30, 2006

Any economist will tell you that increasing transaction cost for a program makes people fall through the cracks. So in theory you can claim they will be still be eligible but in practice less students will be able to benefit from the programs.

So you trash *** opinion is based on ignorance of basic economics. Take that needle out your arm and do better.

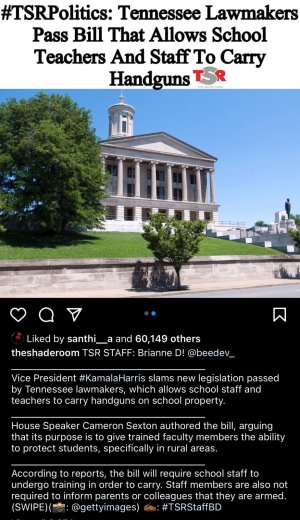

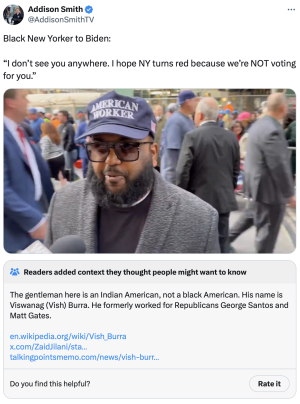

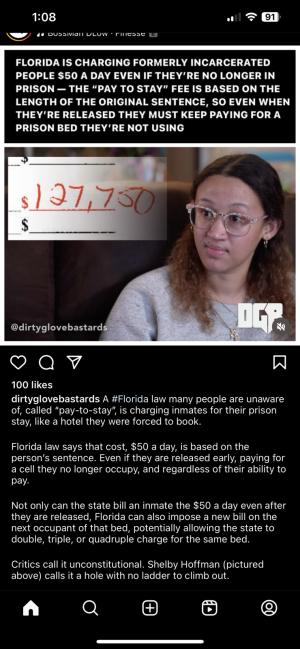

Here is some more ****ery I am sure you support though...

Not sure why you'd think I'd support that. I have stated that we need immigration reform.

Did you support the massive deportation under the prior administration?

Also, you know I defer to you on matters of the economy.