- May 31, 2007

- 4,893

- 3,432

I’m in an investment class now and learning about the different ratios and doing comparative analysis, forecasting, the efficient frontier, hedging with international securities, and all that.

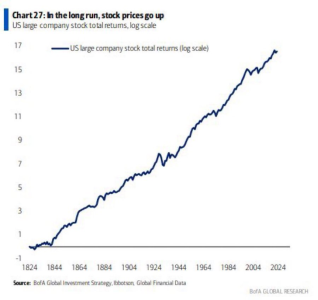

Truth is, DCA’ing into VOO with dividend reinvesting activated is probably the best bet for 99% of us retail investors that aren’t full-time financial analysts. You have roughly a 20% chance of beating the market any given year with far less a chance of beating it again the following year. You have to ask if spending hours upon hours doing the comparative analysis and forecasting is worth a potential .01% gain over the market.

If you want to feel like you are “doing something” you can add a couple REITs, gold, well-known defensive/low beta stocks (Walmart, Home Depot, etc.), maybe an international market ETF with returns exceeding US inflation, and maybe 1-2 low cap growth stocks you’ve done your DD on. Then play with the allocations to make an efficient portfolio. Keeping in mind this approach doesn’t really consider the current economic climate which would impact your allocations over time based on your personal outlook.

Only other piece of advice I can offer is most actively managed portfolios consist of no more than 30-40 stocks. The marginal benefit of adding beyond that is essentially 0. Added risk with virtually no expected reward.

Truth is, DCA’ing into VOO with dividend reinvesting activated is probably the best bet for 99% of us retail investors that aren’t full-time financial analysts. You have roughly a 20% chance of beating the market any given year with far less a chance of beating it again the following year. You have to ask if spending hours upon hours doing the comparative analysis and forecasting is worth a potential .01% gain over the market.

If you want to feel like you are “doing something” you can add a couple REITs, gold, well-known defensive/low beta stocks (Walmart, Home Depot, etc.), maybe an international market ETF with returns exceeding US inflation, and maybe 1-2 low cap growth stocks you’ve done your DD on. Then play with the allocations to make an efficient portfolio. Keeping in mind this approach doesn’t really consider the current economic climate which would impact your allocations over time based on your personal outlook.

Only other piece of advice I can offer is most actively managed portfolios consist of no more than 30-40 stocks. The marginal benefit of adding beyond that is essentially 0. Added risk with virtually no expected reward.