- 2,605

- 6,995

- Joined

- Jul 15, 2018

Yeah it appears the markets are still operating under the assumption that this is going to be a short, abbreviated recession, with no long term lasting effects. In reality, we are starting to see the fringe issues that were previously bubbling up kick in and cause long-term impacts that I don't think are being factored into the market at all or being overriden by a level of Fed intervention on a scale that we have never seen before.

It appears that people are operating under the assumption that once the economy re-opens, everyone is going to be spenders again despite all economic indicators showing that saving rates could climb as high as 11% which may be the highest rate in recorded history. People saving more money = less money being pumped back into the economy. Approximately 70% of our GDP relies on discretionary household spending so by all accounts this means we are in for a long, protracted recession. Additionally, certain segments of the economy rely completely discretionary spending (retail, hospitality, restaurants). These segments of the economy are taking on historic levels of debts just to survive. In the next couple of months you are going to see huge sections of the retail industry start to declare bankruptcy (you are/were already seeing it in retail with Pier 1, Modells, True Religion, Neiman Marcus). I'm fairly certain in the next 3 months we will see Macy's, AMC, JC Penny and many other follow suit. As these businesses die, unemployment goes up/stays up.

Most small businesses were already ****ed, but it appears that only 6% of small businesses actually received funding from the Paycheck Protection Program. Whether or not they needed it that is a different story, but I would guess they would. So you are going to see large swaths of small businesses die which is going to create additional unemployment.

Large entertainment venues (concerts, sports, festivals, theme parks) will likely open in an extremely reduced fashion. Those jobs are ****ed in the near future.

When you factor all that into account, that is going to lead to sustained unemployment, increased defaults on housing and vehicle payments which will lead to foreclosures/repossessions. We were already sitting on a $1.3T subprime auto-loan bubble, this is only going to exacerbate that. Same with a $1.5T student loan bubble that we have been sitting on.

Soon we will probably see a budgetary crises at a state level related to reduced revenues while expenses stay marginally the same. As the stock market drops, state pensions will be completely ****ed. Either those debts will need to be bailed out or let die. If those die, that's another large demographic that is ****ed in terms of discretionary spending. I think that's why we are already seeing states practically beg for additional federal funds.

Meanwhile in federal reserve lala land it appears that they have unleashed unlimited levels of QE and asset purchases. From what I can tell their balance sheet has increased by $6T over the last month or so largely due to additional investments in treasuries and MBS'. It appears that they will take another couple trillion dollars and use that to nationalize the Oil and Gas industry. If MBS' start to become systemically ****ed like they were in 2008 then a large portion of the fed balance sheet becomes complete ****. It appears that they are approaching a willingness to start taking on junk bonds as collateral for debt so if some of these businesses who should have died years ago finally die, then those assets are ****ed.

The short of all of this is it appears that the stock market is being propped up by unprecedented levels of intervention on a scale that we have never seen before. Once reality hits everything is ****ed.

Don't mean to sound like an alarmist and by no means, I am not a macro economist, but this is what I can tell is happened based on reading stuff from people who are much smarter than I am.

And even after this news the equity markets moved up.

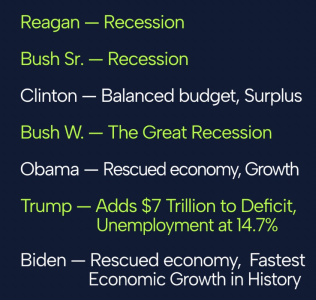

Because before this happened there was blatant manipulation of the market to prop up "a strong economy" and now when we need to use those market tools to prop our economy up. They've been used. The only thing holding the market up now is rich people doing their damndest to make sure either trump gets re-elected (so they have time to rape and pillage everyone) or Biden gets stuck holding the bag (in which case they will rape and pillage to a smaller degree) so Dems share in their blame.

Rusty's suggestion to print money makes sense, inflation is almost a guarantee at this point. We should try to keep people alive and hope this is over before Christmas so at least that bump can keep things going.

The best thing that could happen is the Trump loses the election, Biden is elected, and he ends all federal hiring freezes and passes some FDR level infrastructure projects. The only way we get through this is the federal gov't has to take a larger role in hiring. a lot of businesses and even industries are not going to recover from this.